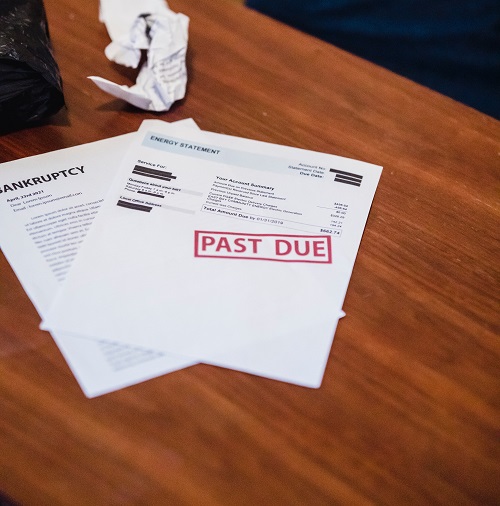

Selling your home during Chapter 13 bankruptcy can be a complicated process. While there are several options available to you, one that may be worth considering is selling to a cash buyer. Here are some tips and advice to help you navigate the process:

Consult with your bankruptcy attorney: Before making any decisions, it’s important to consult with your bankruptcy attorney. They can provide guidance on the best course of action and help you understand how the sale will affect your bankruptcy case.

Research cash buyers: Look for reputable cash buyers in your area. Read reviews and ask for references to ensure you’re working with a legitimate company.

Get a fair offer: Cash buyers will typically make an offer on your home in its current condition. However, it’s important to get a fair offer. Consider getting multiple offers from different cash buyers to ensure you’re getting the best deal.

Understand the terms of the sale: It’s important to understand the terms of the sale, including any fees or commissions that may be charged by the cash buyer. Make sure to read the contract carefully before signing.

Consider the benefits: Selling to a cash buyer can have several benefits, including a quicker sale and avoiding the lengthy process of listing your home on the market. Additionally, cash buyers may be more willing to work with you if your home is in need of repairs.

Selling your home during Chapter 13 bankruptcy can be stressful, but with the help of a bankruptcy attorney and a reputable cash buyer, it can be a smoother process.

DISCLAIMER:

Please note that the information provided in this article is for general guidance only and should not be considered legal, financial, or tax advice. The author is not a lawyer, financial advisor, tax consultant, or any other professional that can provide legal, financial, or tax advice. Please consult with a qualified professional in your area for advice specific to your situation.